It has been almost a year since Facebook changed its name to Meta Platforms (Meta), and the cost of abandoning the Facebook brand in favor of the Metaverse may have been immeasurable.

Stock price plummeted 70% in one year.

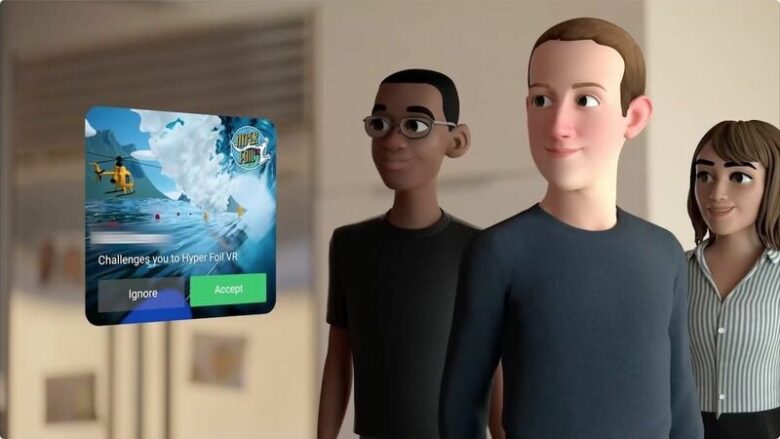

The company’s “Horizon Worlds” was a metaverse application that was rumored to be developed at a cost of $10 billion. However, when CEO Mark Zuckerberg released a teaser image on his Facebook account in August, Meta’s stock price, which had been on a downtrend, accelerated its downward trajectory due to its poor quality.

According to the company’s October 26, 2022 third-quarter results, sales fell 4% year over year to $27.714 billion. It appears that the recent appreciation of the dollar has eroded Meta’s performance due to lower dollar-based advertising revenues, lower growth rates of mainstay social networking services such as Facebook, and companies’ efforts to cut back on ad placements.

In addition, the presence of latecomers such as TikTok, a leading social networking service, has put pressure on Meta’s struggling performance. This is also reflected in Google’s search data: according to Google Trends, as of 2022, the search volume of Instagram and Facebook will be about the same as that of TikTok, indicating the relative weakening of Facebook’s influence.

One possible reason for the decline in advertising volume for companies is the outflow of advertising flow to TikTok, which is on par with Facebook and Instagram and more promising in terms of growth rate.

Meta’s stock price has fallen from a price level of $328 a year ago, when the company changed its name, to a recent price of $95, a plunge of more than 70%. The market capitalization has gone from $870 billion to $250 billion, a loss of $520 billion, or approximately 76 trillion yen at the current dollar-yen exchange rate.

While there is a possibility of a rebound in the short term when the market falls sharply due to some scandal or incident, in the case of Meta, the pattern is that the market has continued to fall steadily for a year due to structural reasons, making it difficult to expect a rebound. It will be difficult for the company to regain its highs anytime soon.

At one time, Meta was an iconic U.S. company as part of GAFA (GAMA) along with Alphabet (Google), Apple (iPhone and macOS), and Amazon (Amazon.com and AWS). As of November 2, the top five U.S. stocks are, in order, Apple, Microsoft, Alphabet, Amazon, and Tesla, with Tesla emerging as a new contender.

In the runner-up spot are financial sector companies that are gaining market capitalization, driven by rising interest rates, such as Warren Buffett’s Berkshire Hathaway, Visa, and JP Morgan Chase. In addition, consumer goods-related companies P&G and Johnson & Johnson, which are expected to see solid demand even in an economic downturn, and retailer Wal-Mart are also faring well while other sectors are reducing their market capitalization.

In the midst of this situation, Meta Corporation, which has quickly fallen down the ranks, has become the most conspicuous, but behind the scenes, semiconductor-related stocks such as NVIDIA and stocks related to the demand for nest eggs such as Netflix and Zoom, which had been touted as star stocks, have also seen their share prices fall sharply over the past year. Nest-dwelling demand-related stocks such as Netflix and Zoom have also seen their share prices fall sharply over the past year. There are also a number of individual U.S. stocks that are facing significant declines, although not as large as Meta, including NVIDIA, Netflix, and Zoom, down 48%, 57%, and 64%, respectively, from the previous year.

Nevertheless, the reason why the S&P 500 Index has remained at -16% year-on-year is that funds that have been flowing into promising tech companies with growth potential are shifting to defensive stocks that are performing steadily in light of the high interest rate situation.

Investing in U.S. stocks has long been booming in Japan. Investors hoping for the perpetual prosperity of major U.S. tech companies have been buying leveraged mutual funds linked to the NASDAQ index, and even those who do not have such expectations have been accumulating mutual funds linked to the S&P 500 index, making U.S. equity investment a “citizenship” in Japan. However, if the past trend is to be followed, it is likely that the U.S. stock market will continue to grow.

However, looking back at past trends, it is rare for a single country’s stocks to dominate the global market capitalization rankings for so long. For example, in 1989, Japanese stocks such as NTT and Industrial Bank of Japan (now Mizuho Bank) dominated the global market capitalization rankings. Even Chinese stocks, which are now being sold off, were once the top-returning investments in the world not so long ago.

Today, it is probably well known that many CEOs in U.S. tech companies are of Indian descent. Moreover, the “Indian power” in the global economy and politics is growing, as evidenced by the election of Snake, the first Indian Prime Minister of the United Kingdom.

This trend is reflected in the Sensex 30 Index, which is India’s version of the S&P 500 Index. Over the past five years, the index has risen 81.21% in value, far exceeding that of the S&P 500.

No matter what the environment, there is a rule of thumb in the market: “There is a bull market somewhere in the world. Even if one appears to be diversified by investing in the U.S. stock index, one cannot grow one’s business or protect one’s assets in the event of an economic slowdown in the U.S. itself.

It may be paradoxical, but it is important to look beyond the U.S. to the rest of the world at a time when attention is focused on the U.S. The creation of a well-balanced strategy will be the key to future stability, both for individual investors and for companies.

コメント